Online NGO Registration Service

NGO (Non-Government Organisation) or Non-Profit Organisation is a kind of entity which is run for various social activities like- Human health, Education, Human Rights, Poverty, environment and many more activities. NGO is categorised in three forms i.e. (a) Trust (b) Societies (c) Section 8 Company (Old Section 25). In case you are confused, we can help you select the right option and guide you through the entire NGO registration process. Tax Seva Kendra offers online incorporation service of NGO for Indian citizen at a much affordable price. Choose a plan according to your nature.

Track Your Status

NGO Registration Service Registration Package

Rs.12,000/-+18% GST

- What we provide

- Documents required

- Certificate of Incorporation (CIN)

- Permanent Account Number (PAN)

- Memorandum of Association (eMOA)

- Articles of Association (eAOA)

- Director's Identification Number (DIN No)

- Digital Signature (DSC)

- Section 8 licence

- Provident Fund (PF)

- Employees State Insurance (ESIC)

- Required two names of the NGO

- Address Proof of the Registered Office (Rent Agreement, Receipt, Electrical Bill)

- Director's PAN, Aadhar

- Director's Last Month Bank Statement or Electric Bill In The Name of Director

- Company Email and Mobile

- NGO Object

- Share Percentage

Benefits of NGO Registration

Let us look at the benefits of NGO Registration.

Several Tax Exemption

NGO's are generally exempted from several central and state taxes in India. If you are involved in any social activities which are carrying under NGO registration, then you will be leaved from the high percentage of corporate tax. But as per the GST Act, some of the services specified in the GST act are liable to pay GST.

Tax Exemption From Donations

After incorporating an NGO, you can apply for donation from the national and international level. But if you are not registered NGO, then you will not be eligible for the said exemption. You can also get individual donations if you are registered because you will have to give them an 80G certificate for their contribution.

Protecting Personal Liability

Another significant benefit of incorporating NGO is that you can protect members of your organisation from personal liabilities. Generally, employees, officers and board members enjoy the benefit of corporate debts and lawsuits; creditors can only claim your NGO's assets, not your personal assets.

Organizational Eternity

As nature and rule, an NGO is separate from its governing body and it has a different legal existence. Means any circumstance arises on members or governing body of the NGO will not end the organisational Eternity. This feature of an NGO makes donors appreciate to donate.

Formalized Structure

With incorporating an NGO, you will need to perform the formalized role with the job description on a regular basis. As doing and running an NGO itself as a great work, it will welcome more people to work with you in hand to hand.

No Salary Payment

NGO's usually do not pay salary to its members. As it is a voluntary based work, there's no need to pay salary to the members. Moreover each volunteer has different expertise, skills and resources which help very much to smooth running the NGO activity.

Types of NGOs in India

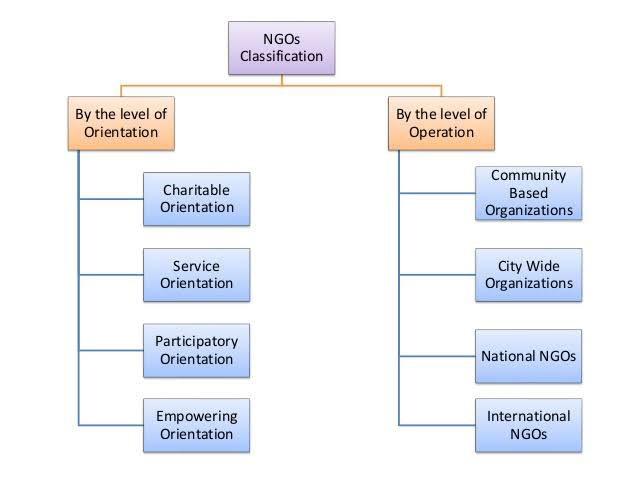

NGOs in India are classified into two broad categories based on the level of Orientation and Operation.

Documents Required for NGO Registration

Mentioned below are the documents required for the registration of the Non-Governmental Organizations.

- Identity Proof (Voter ID/ Aadhar Card)

- Passport (mandatory)

- Proof of residential address ( Electricity/ Telephone/ Mobile Bill or Bank Statement).

- Proof of Registered Office Address (Rent agreement if the premise is not owned by the company).

- Documents proving the ownership such as Sale Deed or House Tax receipt along with a NOC.

- Details of shareholders

- Details of directors

- Income tax PAN (compulsory)

NGO Registration Process

NGO registration process in India can be done in 3 ways: -

- Trust Registration under The Indian Trust Act, 1882

- Society Registration under Societies Registration Act, 1860

- Section 8 Company Registrations under The Companies Act, 2013

Based on the type of NGO Registration i.e., Trust, Societies and Section 8 companies), an applicant needs to follow respective laws and procedure prescribed under the specific act.

We have discussed the NGO Registration process under the three different categories /ways in separate articles.

Timeframe for NGO Registration in India

The time duration varies according to the ways of NGO Registration.

- The registration process of Section 8 Company takes about 10-15 working days.

- The Trust incorporation process takes about 20 to 25 working days, subject to verification by the department.

- The Society registration process takes about 25 to 30 working days, subject to verification by the department.

Cost of NGO Registration in India

The cost of NGO Registration again depends on the type of Registration.

- The cost of registering a section 8 company, including government and professional fees, would range from Rs. 4,999 to Rs. 8,999 approx.

- The cost of trust registration, including government and professional fees, would range from Rs. 13,999 Rs. 17,999 approx.

- The total cost of society registration, including government and professional fees, would range from Rs. 12,999 to Rs. 16,999 approx.

Why choose Tax Seva Kendra - Online NGO Registration Consultant in India

Choosing the suitable form of NGO is very important as it is a one time task but would benefit your organization in the long-run. We at Tax Seva Kendra, offer first free expert consultation to guide you choose the right type of non-profit organization as per your requirements. Get in touch with our professional team to decide which form of non-governmental organization is most suitable for your needs and for more information on NGO Registration.

We have a team of experienced professionals like Company Secretaries, Chartered Accountants, lawyers and other industry experts who are dedicated towards a common objective i.e. customer satisfaction. We will also ensure smooth and hassle free NGO registration services in India.

FAQ on NGO Registration

How much does it cost to open an NGO?

The cost depends on the type of NGO and the number of people registered as members.

When is an NGO eligible for Government funding?

An NGO becomes eligible for Government funding after three years. However, in some exceptional cases, an NGO can get Government funding even after one year if its project gets approved and recognized.

Is it mandatory to register an NGO?

Although it is not mandatory but there are several reasons why it is better to register an NGO. One of the most important benefit is securing Government funds. As an NGO you will b eligible to receive funds from various quarters. Registering your NGO will give it more credibility and increased access to donations.

Need Consultancy? Ask Tax Seva Kendra Expert@ Rs. FREE

- Free Consultancy

- Online Documentation

- Anywhere In India