Online GST Defaults Clearance

GST DEFAULTS - GSTR 3A Notice for Defaulters of GST Return Filing

Did you miss filing your GST returns?? You might expect a notice in Form GSTR 3A anytime soon. GSTR 3A notices issue the return filing for defaulters under GST. Under the GST model, the registered taxpayers need to submit various periodic returns. Non-filing can lead to a levy of late fees and interest accompanied by a notice in Form GSTR 3A.

Track Your Status

GST Defaults Clearance Registration Package

Get Quote

- What we provide

- Documents required

- Free Consultancy

- Case handled by Professional Tax Consultant

- All GST Purchase Bill Related to Default Period

- All GST Sale Bill Related to Default Period

What is GSTR 3A?

GSTR 3A is a form of notice, that the government issues for the non-filing of GST return. It is mandatory for the taxpayers registered under GST to file monthly, quarterly, and annual returns. Failing to do so will cause a notice in GSTR 3A to be issued.

To whom is the notice under form GSTR-3A issued?

GSTR 3A notice will be delivered to taxpayers who have not filed the following GST returns-

- - GSTR 3B (Summary of sale and purchase)

- - GSTR 4 (Composition Dealer)

- - GSTR 5 (Non-resident Taxpayer)

- - GSTR 6 (Input Service Distributor)

- - GSTR 7 (TDS Deductor)

- - GSTR 8 (TCS Collector)

- - GSTR 9 (Annual Return)

- - GSTR 10 (Final Return)

What actions need to be taken after receiving GSTR-3A notice?

When a taxpayer receives a notice under form GSTR 3A then the taxpayer has to file the return within 15 days from the date of notice along with penalty and late fees.

What will happen if the taxpayer does not file a return even after receiving the notice?

If the taxpayer does not file a return even after receiving the GSTR 3A notice then,

- The provisions of section 62 will be applied under the GST act. The assessing officer will calculate the tax liability of the defaulter according to the information provided by the concerned authority.

- The penalty of 10,000 or 10% of the tax due, whichever is higher, will be applicable on the defaulter.

- It could result in cancellation of taxpayer's GST Registration

What will be the applicable late fees and interest for not filing the returns?

- • Interest at the rate of 18% per annum is applied on the outstanding amount of tax from the next day of the due date of filing of return till the date of payment.

Late fees for not filing returns on time are as follows:

For annual return:

- Late fee is Rs. 200 per day (Rs. 100 for CGST Act & Rs. 100 for SGST Act).

- The maximum late fees is 0.25% of turnover in the state.

For other returns:

- Late fee is Rs. 50 per day (Rs. 25 for CGST Act & Rs. 25for SGST Act) as per the notification no. 64/2017

- The maximum late fees is Rs. 5000.

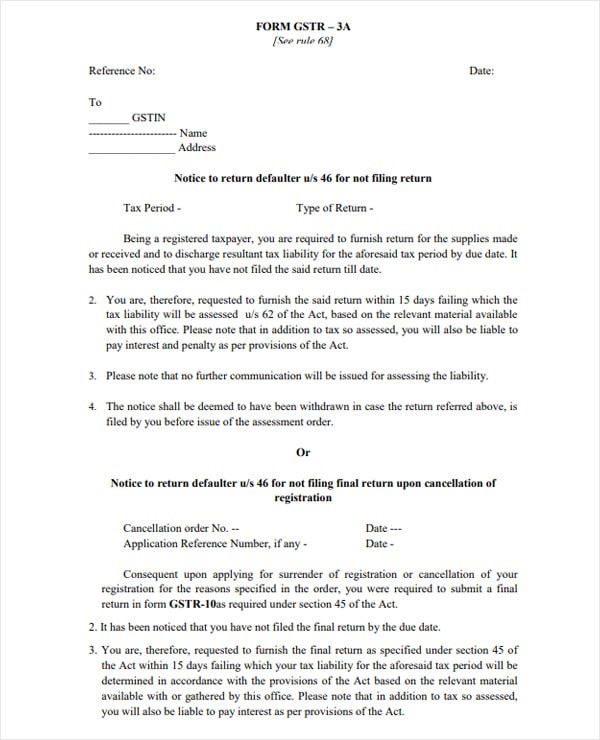

What is the format of GSTR-3A?

Form GSTR 3A is issued in accordance with Rule 48 in the form of notice to:

- The defaulters of GST return filing u/s 42.

- The defaulters of GST return filing whose registration has been canceled under Section 46.

The specified format of the same has been given below for better understanding.

Frequently Asked Questions

What if we file a return after 15 days but before the assessment is done?

If you file the required returns after 15 days but before the assessment takes place by the department in this respect, the notice under GSTR 3A shall stand withdrawn.

What is the difference between GSTR 3B and GSTR 3A?

GSTR 3B is a summarized return of sales and purchases of a registered taxpayer and form. Whereas, GSTR 3A is a notice issued by the GST department for not filing the GST return.

Will I receive further communication from the department on failing to comply with GSTR 3A?

In case you have failed to comply with GSTR 3A notice, no further communication would be forwarded by the government and your case would be assessed as per the best judgement without any further intimation in writing.

What if the registration has been canceled then can the department still issue GSTR 3A?

Yes, even if your registration has been canceled, the department can still issue GSTR 3A and you need to comply with the same and file the return in response to GSTR 3A notice.

Need Consultancy? Ask Tax Seva Kendra Expert@ Rs. FREE

- Free Consultancy

- Online Documentation

- Anywhere In India