Online Import Export Code (IEC) Registration

Import Export Code (IEC) Registration is a mandatory for persons importing or exporting goods and services from India. IE Code is a distinct 10 alphanumeric characters identification number issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries, Government of India. For export services, IEC is not required except when the service provider is taking the benefits of Foreign Trade Policy.

IE code is issued to companies that have PAN card or Company PAN card and Aadhar card along with some other documents like a copy of the cancelled cheque. In the digital era, Tax Seva Kendra can help you get the IE code Registration at the most affordable rates.

Track Your Status

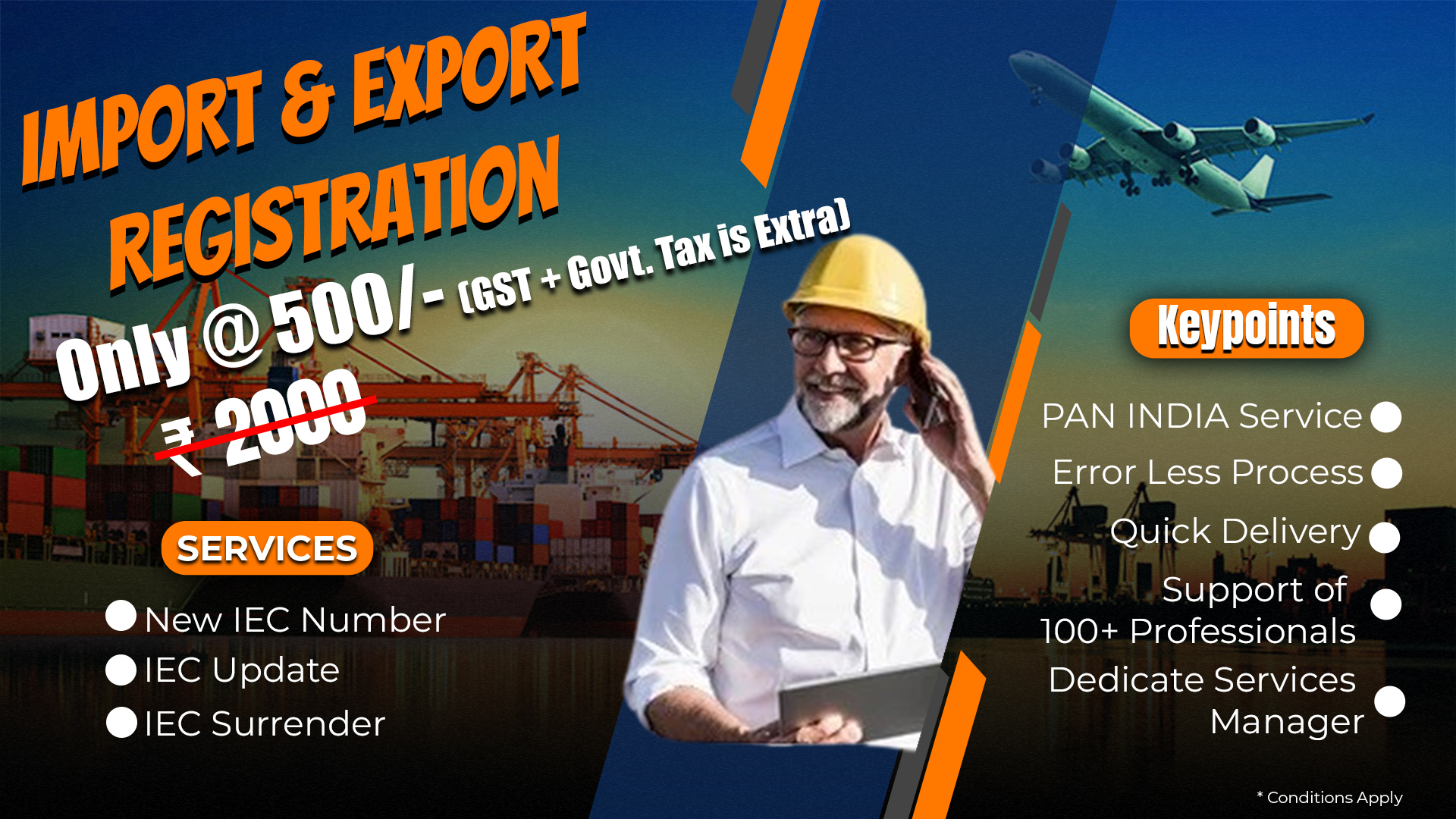

Import Export Code (IEC) Registration Package

Rs.1500/-+18% GST

- What we provide

- Documents required

- IEC Registration Certificate

- Free Consultancy

-

FOR APPLICANT / PROPRIETOR / PARTNER / DIRECTOR

- PAN

- Aadhaar

- Mobile & Email ID

- Applicant Aadhar number must be link with mobile number FOR COMPANY/FIRM

- PAN

- GST / Any Other Licence

- Nature of Business and Name of Business

- Cancelled Cheque in the name of company

- Address Proof

- Electric Bill

Why IEC Registration Is Required

Importers Require IE Code

All Importers who import goods into India require an IE Code. The IE Code is required to clear the customs. Also, when the banks send money abroad, they need the IE Code.

Exporters Require IE Code

All Exporters who export goods or services from India require an IE Code. The IE Code must be quoted while sending shipments and banks require the exporter's IE Code while receiving money from abroad. It is the primary proof of the importers and exporters.

Valid For Lifetime

IE Code is issued for the lifetime of the entity. Once an entity has taken the number the code requires no renewal. Thus, presently if a company is not doing import or export then also can apply for it to use in future. It can be applied online and get it.

Easy Import and Export Procedure

All Exporters who export goods or services from India require an IE Code. The IE Code must be quoted while sending shipments. To clear the customs, make or receive payment from abroad the IE code is mandatory.

IE Code Exemption

An Import Export Code is required for import of any type of goods by a business. However, the following category of persons are exempted from obtaining an IE Code:

- Importer and export by central Government or agencies or undertakings for defence purpose or other specified lists under Foreign Trade (exemption from the application of Rules in certain cases) Order, 1993.

- Import or Export of Goods for personal use.

- Through Indo-Myanmar border areas and China (via NamgayaShipkila, Gunji, and Nathula ports), the parties/individuals who import/export goods to/from Nepal and Myanmar with single consignment must not exceed the value of ₹25,000

- As listed in appendix - 3, schedule 2 of ITC, exemption from obtaining IEC shall not be applicable for export of materials, organisms, special chemicals, equipments& technologies (SCOMET)

- Ministries/departments of central and state governments.

Import Export Code Registration Process

The steps for the Import Export Code Registration processare given below:

Step 1: Prepare Application Form

First, you need to fill up an application form in the specified format – Aayaat Niryaat Form ANF-2A format and file it with the respective Regional office of DGFT.

Step 2: Documents Submission

Secondly, you need to submit the required documents with respect to your identity & legal entity and address proof with your bank details & the certificate in respect of ANF2A.

Step 3: Filing Application

Once your application is completed, you need to file the application with DGFT via DSC (Digital Signature Certificate) and pay the required fee for the IEC Registration.

Step 4: IEC Code

Finally, once your application and documents are verified and approved then you would receive the IEC Code in a soft copy from the authority.

Documents required for IEC (Import Export Code) Registration

For IEC Code Registration, the following documents are required:

- Individual’s or Firm’s or Company's copy of PAN Card.

- Individual's voter id or Aadhar card or passport copy.

- Individual's or company’s or firm's cancel cheque copies of current bank accounts.

- Copy of Rent Agreement or Electricity Bill Copy of the premise.

- A self-addressed envelope for delivery of IEC certificate by registered post.

Timeframe for IEC Registration

IEC registration can be obtained within 5-7 working days after submission of all required documents and application form.

IEC Registration Fees

IEC registration fees range from about Rs. 1500 to Rs. 3500 excluding GST.

Why TAX SEVA KENDRA?

- Our experts will guide you throughout the process

- We have experience in different types of registration for many years

- Our experts will complete the import export code registration process smoothly and at the most affordable rates

- We are time and result oriented. We will get you the license quickly

FAQ on IEC Registration

What is IE code?

IEC stands for import export code which is a 10-digit number issued by the director general of foreign trade, department of commerce and government of India. It is a registration necessary for traders importing or exporting goods and services to or from India.

Is there any tax levied based on IE code?

IE code is not a tax registration. Though, certain customs duty may be levied depending on the product.

What is the penalty levied for not registering for IE code?

As trade is not possible without a valid IEC, the penalty levied may be the pay duty depending upon the quantum of the goods.

How many IECs can a person have?

A single business owner can obtain only one license.

Can IEC be cancelled?

IE code can be cancelled by making a formal request to the DGFT online. Thereafter, the authorities will cancel it electronically.

Need Consultancy? Ask Tax Seva Kendra Expert@ Rs. FREE

- Free Consultancy

- Online Documentation

- Anywhere In India