Online GST Return Filings - Overview

GST (Goods and Service Tax) is an indirect tax in India imposed by the Central government effective from 1st July, 2017. Since then, many old indirect taxes have been converted into GST. From the beginning of purchasing of raw materials and end to sale products to the consumers, GST is applicable. As a result, small to large enteritis are required to GST return filing. To make the process easy and smooth Tax Seva Kendra has created an online GST e-Filing Service for Indian business owner.

Track Your Status

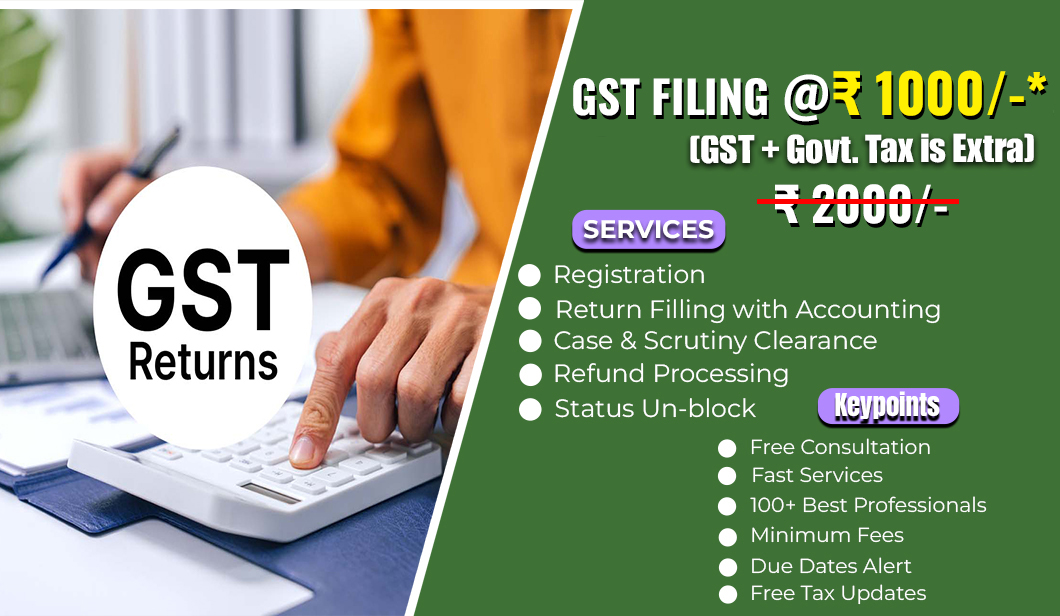

GST Return Filings Registration Package

Rs.1000/-*+18% GST

- What we provide

- Documents required

- Free Consultancy

- GST Return copy in PDF Format

- Delivery in 2 Days

- All GST Purchase Bill

- All GST Sale Bill

- HSN Codewise Summary of all Goods Sold

- GST ID and Password

Types of GST Return

GSTR-1 FILING

All the records of sales come under GSTR1 filing. The suppliers report their outward supplies for the reporting months under this form. According to GSTR-1, a registered taxpayer must file its return by 10th of the following month or quarter.

GSTR-3B FILING

GSTR-3B is a self-declaration for each month, filed by every registered person under GST. It is a simplified summary return of inward and outward supplies, and once filed cannot be revised. GSTR-3B must be filed by 20th of each month.

GSTR-4 FILING

Dealers belonging under Composition Scheme must file GSTR-4 return. Normally, Taxpayers need to file three monthly returns under GST, however a Composition Dealer is only required to file one GSTR-4 return each year by 30th April following the closing year.

GSTR 9 Filing

All the taxpayers registered under GST needs to file their annual return in GSSTR-9 filling by 31st December of every year. All the information about monthly/quarterly returns filed in that year must be filed under GSTR-9 by the registered Taxpayers.

GSTR 9A Filing

Dealers opting for composition schemes needs to file an annual return of GSTR-9A. The composition taxpayers must include all the information of their quarterly returns for the Fiscal Year, and it should be filed before the Last day of December, each year.

GSTR 9C

GSTR 9C is The Reconciliation Statement between the Annual returns filed in GSTR 9 in a Fiscal Year. A copy of the audited annual book of accounts must be included by the taxpayer for the GSTR-9C file. This must be filed before 31st December of each year.

Documents Required

Following are the documents required for GSTR filing.

- Invoices issued to persons with GSTIN or B2B.

- Invoices issued to persons without GSTIN or B2C invoices. This needs to be submitted only when its total value is above 2.5 lakhs.

- A consolidation of inter-state sales.

- HSN-wise summary of all goods sold.

- Any other debit or credit notes or advance receipts.

FAQ on GSTR Filing

What is the QRMP scheme?

The QRMP scheme applies to registered taxpayers who have an aggregate turnover equal to or less than ₹5 crores in the previous financial year. Under this scheme, businesses will be allowed to file returns every quarter instead of every month. Although taxes have to be paid every month.

Can we revise the returns?

Unfortunately, it is not possible to revise the GST returns. That is why it is advised to seek help from professionals to file your returns. Changes can be made in the next period’s return form amendment section.

Is GST paid every month?

Yes, GST has to be paid every month on its due date. You have to first pay GST and then file its returns.

Need Consultancy? Ask Tax Seva Kendra Expert@ Rs. FREE

- Free Consultancy

- Online Documentation

- Anywhere In India